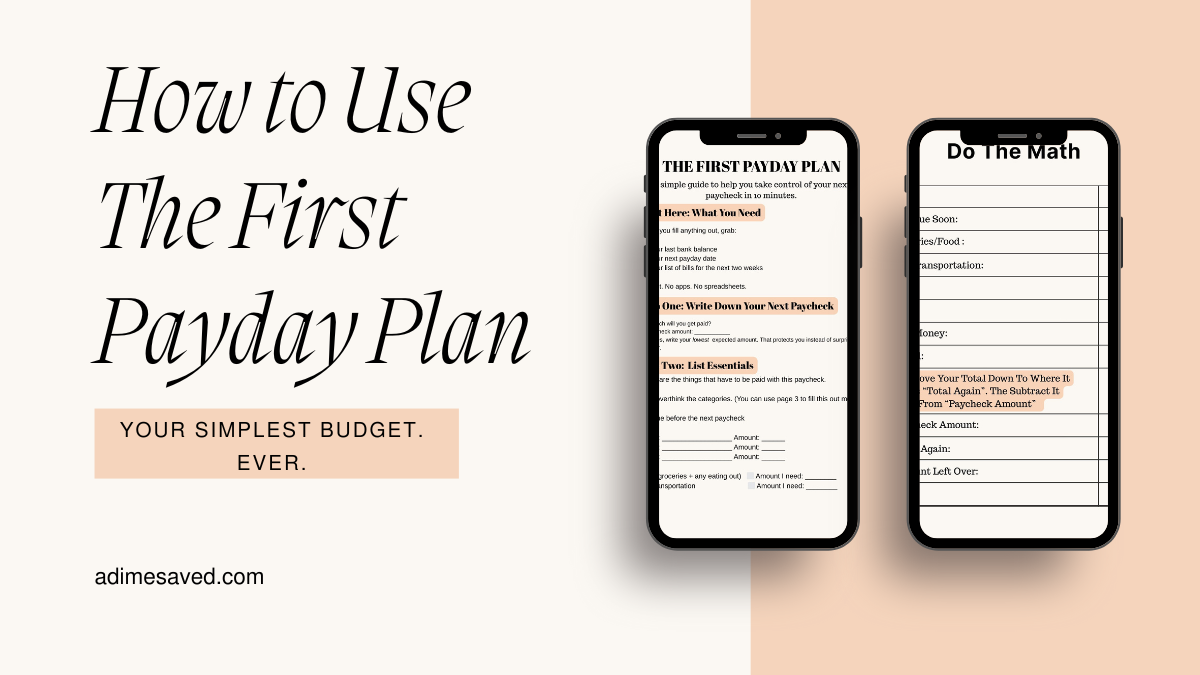

A simple, step-by-step guide that takes 10 minutes.

Start With Your Next Paycheck (Not the Whole Month)

Look at the amount you expect to get paid next. Write that number at the top of the worksheet.

If your income changes, use the lowest amount you might receive. This keeps everything realistic and stress-free.

List Only What Must Be Paid Before Your Next Payday

On the main sheet, write down every bill that will come out between this paycheck and your next one.

This is things like:

• Rent or mortgage

• Utilities

• Phone/internet

• Subscriptions or automatic payments

• Minimum debt payments

Don’t add extra categories. Don’t overthink it. Just write what applies right now.

Set Simple Amounts for Your Essentials

Next, fill in the three everyday categories:

Food (groceries + eating out)

• Gas/transportation

• Fun money (yes, you get some — this helps you stay on track)

Pick numbers that feel doable for this paycheck. You can tweak them later.

Add Everything Up

Use the quick math section to subtract:

Total bills

Food

Gas

Fun money

The worksheet will show you how much money you have left over.

If the number is negative, don’t panic — just adjust one category at a time.

Use the Bill Tracker (Page 3)

Fill out the bill tracker once and keep it handy. This page helps you remember:

What each bill is

• When it’s due

• How much it is

• If it’s been paid yet

This page becomes your “master list” so you don’t forget or miss anything in future paychecks.

Write Your Final Numbers on the Calculation Page (Page 4)

Once you’ve done the rough work on Page 2, rewrite the final clean numbers on Page 4.

This becomes your go-to snapshot for the entire pay period.

Include:

• Final totals

• Any notes

• A reminder date to check back in

This page is great to screenshot or keep visible for quick reference.

Keep Your Plan Where You Can See It

Put it somewhere you’ll actually look at:

• Your planner

• Your fridge

• Your desk

• Your phone (screenshot it!)

Visibility = consistency.

Repeat Every Paycheck

This system is designed to be simple enough to redo again and again.

Each paycheck gets easier — and the more you repeat the steps, the more confident you’ll feel.

That’s it — budgeting in less than 10 minutes.

You don’t have to be perfect. You just have to start with the paycheck right in front of you.