Perhaps you’re new to budgeting and would like to find an easy way to get started. Maybe you’re just looking for a budgeting update because there are tons of ways to do this, although the ‘Budgeting by Paycheck’ method may be one of the easiest ways to go about budgeting.

This method of budgeting requires you to budget every time you get a paycheck as opposed to budgeting every month. Read on to learn more about how to achieve success with the paycheck budgeting method.

Use a Calendar or Other Medium

A monthly budget planner, a printable calendar, or even a digital one is essential if you’d like to get started with a paycheck budget. If you’re the kind of person who loves using a spreadsheet to plan things, then this could also work.

Whatever medium you decide to use to plan your budget, just make sure it’s easily accessible and one that you will check and utilize regularly.

Add to Your Calendar or Planner

Once you have decided on the planner you will be using, it’s time to add your paycheck and any other bills you may have. Bills may include fixed expenses such as mortgage or rent, car payments, debt payments, and loans, to name a few.

Tally Expenses

Next, you need to add the amount of money spent on things like food and other necessities such as pets, etc. Lastly, you need to budget for fun activities or expenses outside of your needs, such as subscriptions, vacations, drinks with friends, etc.

If you aren’t certain how much money you spend on entertainment and such, then it could be a good idea to check the past month’s bank statement to find the rough average of this spending.

Include Savings and Sinking Funds

In an ideal world, everyone has some money remaining after paying mandatory bills and other expenses that can go towards a savings account, an emergency savings fund, or simply a sinking fund. These are all crucial to prevent you from going into debt, as they will allow for infrequent expenses or unplanned costs, such as emergencies, without breaking the bank.

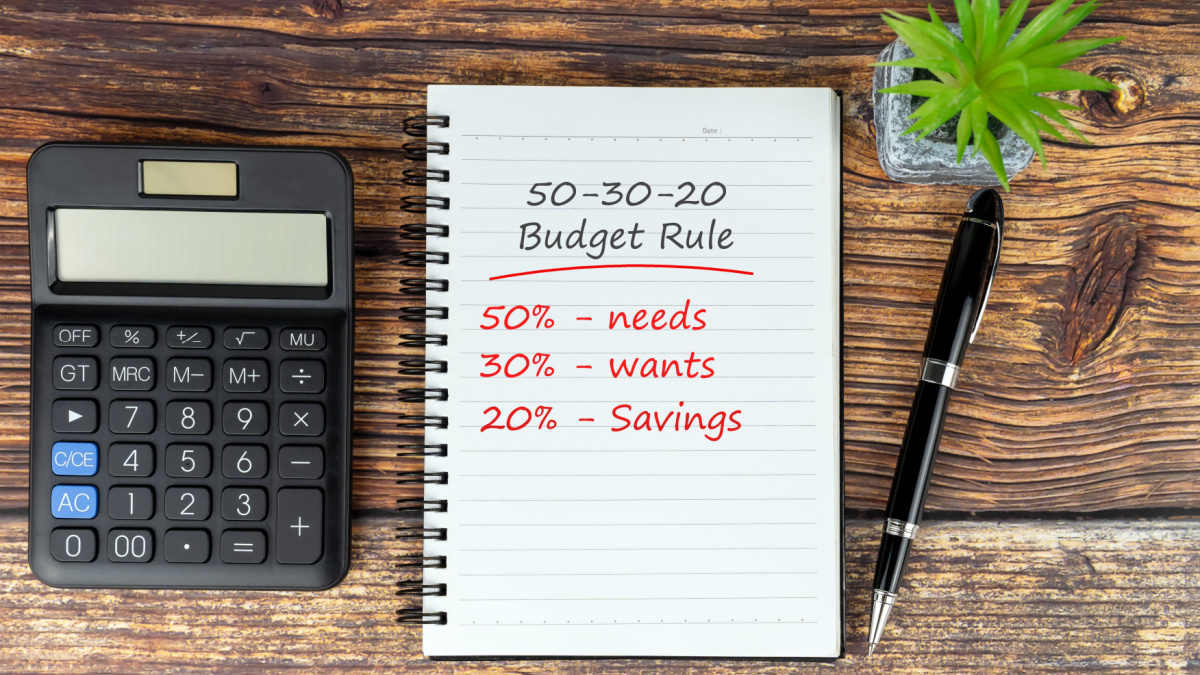

How Much Should You Save?

The amount you should save each month will be greatly dependent on your earnings. It also depends on how much money you spend on loans, rent, mortgages, and so forth. If your finances allow, then you’d probably want to save a minimum of 20% of your incoming money each month.

Assign Each Expense To a Suitable Paycheck

A good way to match expenses with a paycheck is to use a color-coded highlighter. Say you get paid weekly or bi-monthly; you’re probably going to pay most of your bills for the following month with the last paycheck of the current month.

Track Budget

If you want to achieve success with any budget, it’s really important to track it. By tracking your budget for a few weeks and even months after setting it up, you can easily identify areas that need work or if you need to make any changes to save more money for investments or perhaps buying a house.